-

- Why are you making this change now?

- What took you so long?

- What steps are you taking to address your workflow challenges?

- What other changes can I expect?

- Remind me again. How are you guys paid?

- What changes will you be making to your Assets Under Management (AUM) fee for investment services?

- Will there be any other changes to your Assets Under Management fee?

- Will the higher fees apply to all of my dollars with your firm?

- What changes are you making to your Financial Planning fees?

- How much will my fees increase?

- Are these fees competitive with other advisors?

- What are you doing to keep the firm stable if Jim leaves, dies, or retires?

- When will I start paying the new fees?

- How will these changes affect my relationship with your firm?

- I just began working with TGS Financial Advisors under one fee structure, and now you’re changing your fees. I feel like this is a bait-and-switch.

Why are you making this change now?

For the last two years, we’ve been working to benchmark our firm against some of the very best advisory firms in the fee-only space. We’ve learned two important things:

- Our services and credentials are competitive with some of our top peer firms. As of mid-year 2024, we have four CFP®s, an RMA®, two CIMA®s and one CPWA® on staff. Our expanded client service team has over 50 years of financial industry experience.

- Our fees are low. Our combined revenues from investment advisory and financial planning fees are only about 60% of what the typical high-end firm charges.

Working with a top industry consultant, we’ve realized that we can’t maintain our desired level of client service without receiving competitive compensation.

We last changed our fees in 1991. A change was overdue.

What took you so long?

Over time, costs have increased, first gradually, and then over the last few years explosively.

Ten years ago, with our current fee structure, we were able to fully staff the practice, pay competitive compensation, invest in growth, host client events several times a year, and fulfill our compliance responsibilities as a Registered Investment Advisor.

Today, we’re doing our best technical work ever, and at the same time it feels like we’re running harder and harder to stay in the same place. We’ve struggled to balance the competing demands of technical work for existing clients, planning for new clients, and simply staying in touch with our clients through active and regular communication.

What steps are you taking to address your workflow challenges?

We’re investing heavily in our team to improve services. In the last year, we’ve added two team members to the planning team, one to the client service team, one to the technology team, and we have another advisor starting July 1. We’re already investing in building client-facing capacity even before we adjust our fees.

As our new team members gain knowledge, experience, and credentials, we’ll be able to reduce the number of clients each advisor serves, and at the same time, support each client family with a more capable advisor/planner team.

What other changes can I expect?

Communication and community are crucial to our practice. The ongoing informal process of simply touching base with our clients, getting updates on what’s going on with each of you, and sharing our thoughts about the financial landscape, is one of our most important responsibilities. It’s how we identify financial problems before they emerge. It’s how we nurture and deepen relationships.

We believe it’s vital to create opportunities for team members to engage with clients and their families in less formal settings. Expect more scheduled office functions and roundtable discussions, starting with a client appreciation event this fall.

Remind me again. How are you guys paid?

On an ongoing basis, we’re paid two ways. We charge a quarterly pro-rated Assets Under Management fee as a percentage of the value of the investments we actively manage for our clients, and we also charge a Financial Planning fee for the non-investment financial advice we provide for most clients.

A small number of clients don’t have any investments we actively manage for them, and some clients don’t engage us for financial planning.

We also have a different flat-fee advice model solely for young physicians, our TriageMD FoundationsTM program.

What changes will you be making to your Assets Under Management (AUM) fee for investment services?

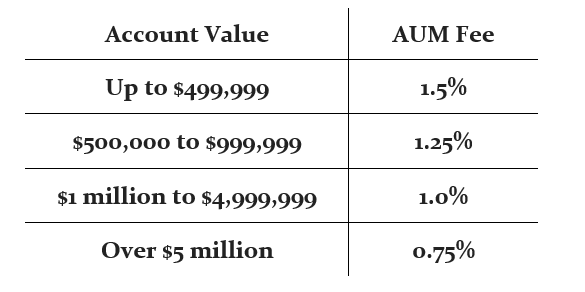

Our fee schedule will stay the same, but our mechanism for calculating fees will change to become consistent with best practices among some of the top-tier advisory firms. The result will be an increase in fees charged in most circumstances.

Our prior AUM fees were based on a threshold or breakpoint structure, which charged each client household a single percentage based on the total portfolio assets managed for that client. Someone with $499,999 would pay a calculated fee of 1.5% on that entire amount, or $7,500. Add one dollar of assets to equal $500,000 and the entire portfolio would be billed at 1.25%, or $6,250.

One obvious problem with this type of breakpoint pricing is that a portfolio loss can cause a fee increase. For example, if a client’s portfolio declined by 10%, from $500,000 to $450,000, their fee would actually increase from $6,250 to $6,750, an increase of 8% after a loss of 10%.

A more subtle problem is that breakpoint pricing introduces regulatory or compliance challenges. For example, if a client has an account managed by a sub-advisor, and we reduce our share of the fee to 0.75%, does that account value get added to the total portfolio for the purpose of qualifying for a higher breakpoint and a lower fee?

Few firms use this pricing model. Most firms use a blended or tiered fee model, in which the first $500,000 of assets for every client are charged the same 1.5%, and the next $500,000 the same 1.25%. Instead of paying a single percentage based on the maximum asset value, each tier of assets pays a consistent percentage. As assets grow, the next dollar of assets eventually pays a smaller fee.

Starting July 1, we will adopt the industry standard of a blended or tiered fee structure. Typically, the first $500,000 of managed assets will be charged a 1.5% fee, the second $500,000 charged 1.25%, and so on.

Will there be any other changes to your Assets Under Management fee?

In some cases, we’ve discounted our fee as a courtesy, and as a result we’re charging fees well below our published schedule. For example, we have clients with less than $500,000 in assets under management who are paying 1% instead of our published fee of 1.5%.

We plan to eliminate fee discounts under all but extraordinary circumstances.

Will the higher fees apply to all of my dollars with your firm?

Not necessarily. We plan to continue our practice of segregating certain assets that aren’t actively managed and exempting them from all AUM fees.

For example, for most retired clients we’ll continue to recommend maintaining a low-risk reserve account with two years’ worth of spending. We won’t charge any AUM fees on those reserve accounts.

Similarly, if a client is holding cash for a real estate purchase in the near future, or some other non-portfolio reason, we’ll continue to keep that cash in a non-supervised account with no AUM fee charges.

The same practice will hold in cases where we’re gradually committing dollars under a dollar-cost averaging strategy. Dollars awaiting investment won’t be charged AUM fees.

Finally, static bond or CD portfolios will be charged either a lower fee, or in some cases no fee.

What changes are you making to your Financial Planning fees?

On the planning side, we plan to replace our prior three levels of planning with four levels. These four levels and the associated fees will be as follows:

Basic $2,000 per year

Enhanced $4,000 per year

Complex $6,000 per year

Concierge $10,000 per year

We’re still in the process of buying and building out the analysis and reporting tools we’ll need for the more complex planning capabilities we’re adding, such as AI-supported tax return and estate planning reviews. We’re also continuing to hire capable new team members to add to our planning and advisory teams.

The new planning fees won’t go into effect until calendar year 2025. The enhancements to our planning process, including expanding our planning support team to three planning associates, will be rolled out over the next six months of 2024. Again, we’re investing in our ability to deliver superior services before we start charging for those services.

How much will my fees increase?

We’re happy to have individual conversations about how your fees will change.

Are these fees competitive with other advisors?

We believe these fees are more than fair. After these fee changes, we’ll still be charging less than some other high-end practices we know well from study groups and office exchanges.

What are you doing to keep the firm stable if Jim leaves, dies, or retires?

We are continuing to implement our long-term plan to assure the continuity of our advisory firm across generations.

We’ve already begun to bring in a third generation of advisors-in-training, Yousef Almbaid and Caroline Kiser. They are learning from Tom and Audrey and supporting those senior advisors in delivering superior advice to clients. In the coming years, we expect Yousef and Caroline to become qualified and expert financial advisers themselves.

Part of ensuring continuity is sharing equity with key next-generation team members.

One of the crucial reasons we need more cash flow is that sharing equity is a taxable transaction. We need to provide Tom and Audrey with the funds needed to buy into TGS on a discounted basis.

When will I start paying the new fees?

For Assets under Management fees, the new fee structure will be charged starting with the first quarterly billing cycle after each client has signed the new Advisory Agreements.

The new planning fees won’t be charged until calendar year 2025.

How will these changes affect my relationship with your firm?

Our goal is to provide high-quality service to every client household, aligned with each family’s needs and ability to pay.

Our practice model is the financial equivalent of concierge medicine. We want each advisor to work with a limited number of clients, supported by a dedicated team. This structure is designed to allow our advisors to understand their clients deeply and respond to them quickly.

Most advisory practices are reactive. They respond when a client comes in the door with a spear in their chest. Our goal is to be proactive. By reducing the number of clients each advisor serves, our advisors will be able to think about their clients even when those clients aren’t in front of them, identifying new ways to help each family achieve better outcomes.

I just began working with TGS Financial Advisors under one fee structure, and now you’re changing your fees. I feel like this is a bait-and-switch.

Anyone who began working with the firm within the last three years will continue to be charged under the old fee structure for three years from the date they executed their investment or planning agreements.