Five Highlights from SECURE 2.0

ON DECEMBER 23, 2022, Congress passed the SECURE 2.0 Act, building on legislation passed in late 2019 with many changes meant to strengthen the retirement system. Here are five key areas we’re highlighting for our clients.

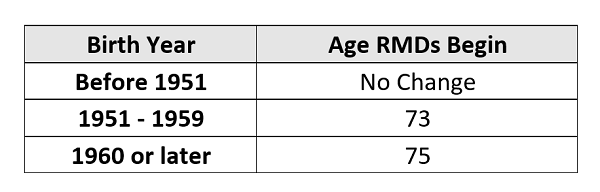

The age for required minimum distributions (RMDs) increases from 72 to 73 starting on January 1, 2023. The age will further increase to 74 starting in 2030 and then 75 starting in 2033. If you turned 72 in 2022 or earlier, you must continue to follow your existing RMD schedule.

Higher catch-up contributions. Beginning January 1, 2025, those who are age 60 through 63 can make catch-up contributions to workplace plans up to $10,000 each year, and that amount will be indexed to inflation. That’s an increase from the $7,500 allowed for those who are 50 or older in 2023. Note: If you earn more than $145,000 in the previous year, catch-up contributions at age 50 or later must be made in a Roth account in after-tax dollars.

Qualified Charitable Distributions (QCDs) Enhancement. Those who are 70½ or older can transfer up to $100,000 tax-free each year from their traditional IRAs directly to qualified charities and have the amount count toward their annual RMD (if applicable). Beginning in 2023, a one-time only, up to $50,000 QCD to a charitable remainder unitrust (CRUT), a charitable remainder annuity trust (CRAT), or a charitable gift annuity will be allowed as part of the QCD limit. Also, the QCD limit of $100,000 will be indexed for inflation starting in 2024.

Workplace Roth Accounts Become Exempt from RMDs. Unlike Roth IRAs, Roth accounts in workplace plans have been subject to RMDs during the owner’s lifetime. Beginning in 2024, this will no longer be the case as workplace Roth assets will become exempt from lifetime RMDs.

529 Plans Rollovers Allowed. Effective January 1, 2024, beneficiaries of 529 college savings accounts are permitted to rollover up to $35,000 over the course of their lifetime to a Roth IRA in their name. These rollovers are subject to Roth IRA annual contribution limits and compensation requirements. Also, the 529 account must have been in existence for at least 15 years and contributions or earnings from the last five years cannot be rolled over.

We welcome any questions or discussions about this new legislation. However, please remember that we are not tax professionals and you should always consult your CPA regarding your particular situation. As always, we’re happy to collaborate with the financial professionals on your team.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by TGS Financial Advisors), or any non-investment related content, made reference to directly or indirectly in this article will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from TGS Financial Advisors. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. TGS Financial Advisors is neither a law firm nor a certified public accounting firm and no portion of this article’s content should be construed as legal or accounting advice. A copy of the TGS Financial Advisors’ current written disclosure statement discussing our advisory services and fees is available upon request.