Midterm Elections: What Do They Mean for Markets?

It’s Election Day in the US once again. For those who need a brief civics refresher, every two years the full US House of Representatives and one-third of the Senate are up for reelection.

“Markets have historically continued to provide returns over the long run irrespective of which party is in power at any given time.”

While the outcomes of the today’s elections are uncertain, there have been plenty of opinions and prognostications ahead of the actual voting. These will no doubt continue post-election, and in financial circles will almost assuredly include thoughts about possible impacts on markets. But should long-term investors focus on midterm elections?

As we’ve so often pointed out, there is no reliable relationship between one political party’s success (or failure) and the performance of either the financial markets or the real economy. Given the unusually elevated engagement of the voters in tomorrow’s mid-term elections, we thought it might be helpful to revisit some of the data around election results in general, and mid-term contests in particular.

Markets Work

We would caution investors against making short-term changes to a long-term plan to try to profit or avoid losses from changes in the political winds. For context, it is helpful to think of markets as a powerful information-processing machine. The combined impact of millions of investors placing billions of dollars’ worth of trades each day results in market prices that incorporate the aggregate expectations of those investors. This makes outguessing market prices consistently very difficult.[1] While surprises can and do happen in elections, the surprises don’t always lead to clear-cut outcomes for investors.

The 2016 presidential election serves as a recent example of this. There were a variety of opinions about how the election would impact markets, but there was broad consensus about two aspects of the 2016 election: Trump was going to lose, and in the unlikely event he won, markets would surely fall.[2] The day following President Trump’s win, however, the S&P 500 Index closed 1.1% higher. So even if an investor could have reliably predicted the election’s surprise outcome, they would probably have gotten their buy/sell strategy backwards.

But what about congressional elections? For the upcoming midterms, market strategists and news outlets are still likely to offer opinions on who will win and what impact it will have on markets. However, data for the stock market going back to 1926 shows that returns in months when midterm elections took place did not tend to be that different from returns in any other month.

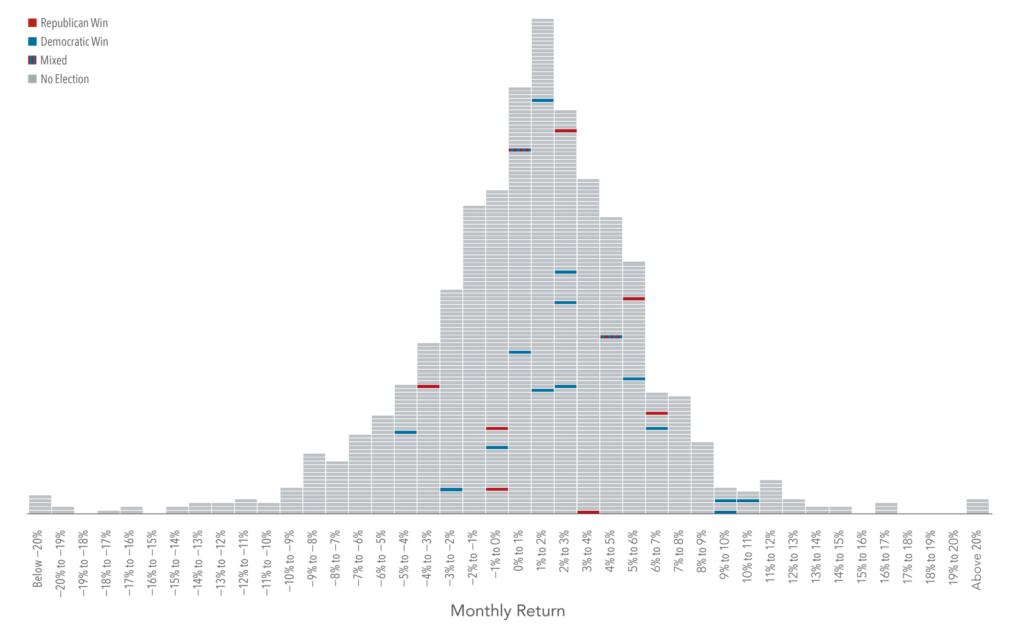

Exhibit 1 shows the frequency of monthly returns (expressed in 1% increments) for the S&P 500 Index from January 1926–August 2018. Each horizontal dash represents one month, and each vertical bar shows the cumulative number of months for which returns were within a given 1% range (e.g., the tallest bar shows all months where returns were between 1% and 2%). The blue and red horizontal lines represent months during which a midterm election was held, with red meaning Republicans won or maintained majorities in both chambers of Congress, and blue representing the same for Democrats. Striped boxes indicate mixed control, where one party controls the House of Representatives, and the other controls the Senate, while gray boxes represent non-election months. This graphic illustrates that election month returns were well within the typical range of returns, regardless of which party won the election. Results similarly appeared random when looking at all Congressional elections (midterm and presidential) and for annual returns (both the year of the election and the year after).

Exhibit 1. Midterm Elections and S&P 500 Index Returns, Histogram of Monthly Returns

January 1926–August 2018

Past performance is not a guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. S&P data © 2018 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

Past performance is not a guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. S&P data © 2018 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

In It for the Long Haul

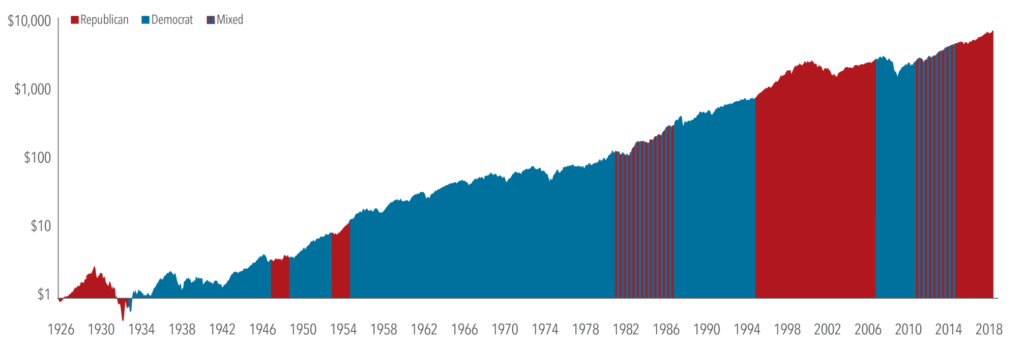

While it can be easy to get distracted by month-to-month or even one-year returns, what really matters for long-term investors is how their wealth grows over longer periods of time. Exhibit 2 shows the hypothetical growth of wealth for an investor who put $1 in the S&P 500 Index in January 1926. Again, the chart lays out party control of Congress over time. And again, both parties have periods of significant growth and significant declines during their time of majority rule. However, there does not appear to be a pattern of stronger returns when any specific party is in control of Congress, or when there is mixed control for that matter. Markets have historically continued to provide returns over the long run irrespective of (and perhaps for those who are tired of hearing political ads, even in spite of) which party is in power at any given time.

Exhibit 2. Hypothetical Growth of $1 Invested in the S&P 500 Index and Party Control of Congress

January 1926–August 2018

Past performance is not a guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. S&P data © 2018 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

Past performance is not a guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. S&P data © 2018 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

Equity markets can help investors grow their assets, and we believe investing is a long-term endeavor. Trying to make investment decisions based on the outcome of elections is unlikely to result in reliable excess returns for investors. At best, any positive outcome based on such a strategy will likely be the result of random luck. At worst, it can lead to costly mistakes. Accordingly, there is a strong case for investors to rely on patience and portfolio structure, rather than trying to outguess the market, to pursue investment returns.

[1]. This is known as the efficient market theory, which postulates that market prices reflect the knowledge and expectations of all investors and that any new development is instantaneously priced into a security.

[2]. Examples include: “A Trump win would sink stocks. What about Clinton?” CNN Money, 10/4/16, “What do financial markets think of the 2016 election?” Brookings Institution, 10/21/16, “What Happens to the Markets if Donald Trump Wins?” New York Times, 10/31/16.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by TGS Financial Advisors-“TGS”), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from TGS. Please remember that if you are a TGS client, it remains your responsibility to advise TGS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. TGS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the TGS’s current written disclosure Brochure discussing our advisory services and fees is available for review upon request.