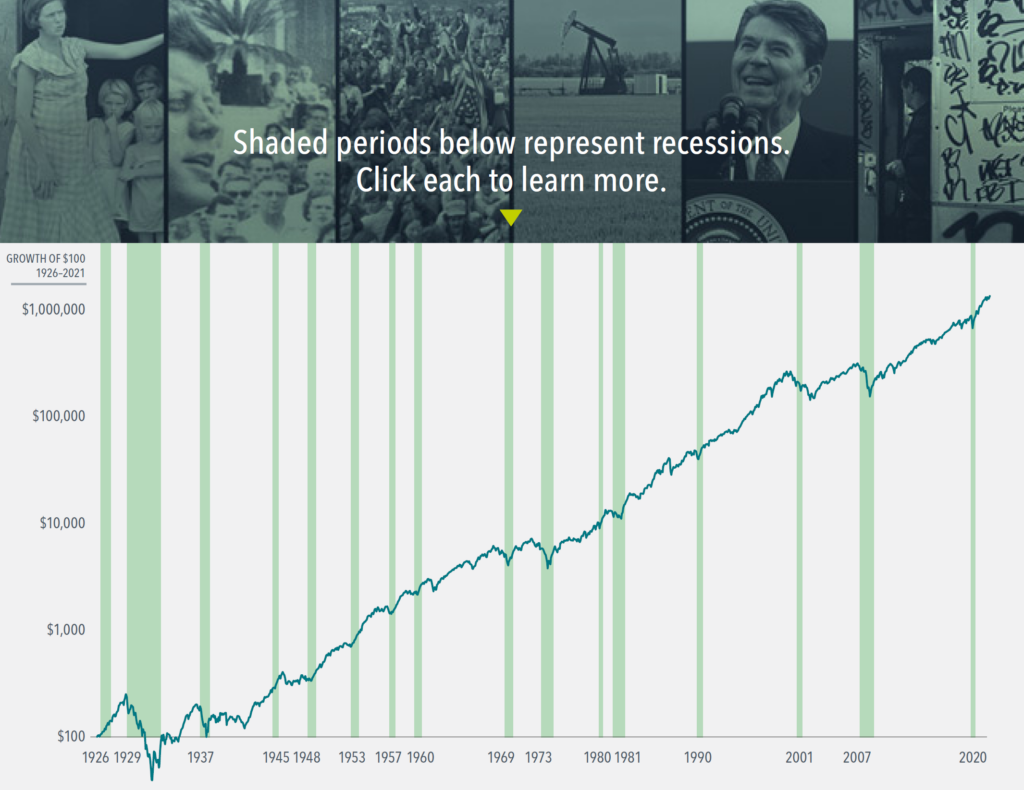

Returns Through a Century of Recessions

Here’s a fascinating analysis from our friends at Dimensional Funds. Remembering my grandfather’s experiences as a growth stock investor in the late 1960s, and having lived through the 70s and 80s as an advisor, two facts stand out:

1) The potential downside losses when a bubble bursts can be much larger than we’ve seen so far in this year’s bear market.

2) The stock market eventually recovers from even the most brutal bear market declines.

As an investor with a higher risk tolerance*, I plan to keep most of my own portfolio in stocks, and I also plan to keep most of my funds in less-speculative, cheaper value stocks.

*Some of our clients have a lower risk profile and may have less stocks than I do.

By James S. Hemphill, CFP®, CIMA®, CPWA®/ Managing Director & Chief Investment Strategist

Jim has been a CERTIFIED FINANCIAL PLANNER™ professional since 1982. Jim specializes in complex wealth transfer and retirement transition strategies and coordinates TGS Financial’s investment research initiatives.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by TGS Financial Advisors), or any non-investment related content, made reference to directly or indirectly in this article will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from TGS Financial Advisors. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. TGS Financial Advisors is neither a law firm nor a certified public accounting firm and no portion of this article’s content should be construed as legal or accounting advice. A copy of the TGS Financial Advisors’ current written disclosure statement discussing our advisory services and fees is available upon request.