The Essentials of Personal Record Retention: A Practical Guide

Table of Contents

Rule 1: Safe and accessible storage of documents

How long does Raymond James retain your documents?

How long do banks retain statements?

Personal records to keep forever

Homeowner records to keep indefinitely

Why you should keep home improvement records

Tax-related financial documents to retain for 7 years

Records to retain during length of ownership

Retention guidelines for insurance policies

Retention for bills and bank statements

Rule 2: Safe disposal of your documents and devices

Things you should be shredding

Some resources

WE’RE PRETTY SURE YOU’VE NOTICED that in an increasingly paperless society, there’s still plenty of paperwork. You’re not alone if you’ve found yourself staring at certain documents and asking, do I need to expend the energy to keep these?

This guide to personal record retention is bookended with two essential rules. Be sure to check out the disposal rule at the end. TGS encourages clients to drop by the office and deposit documents that need shredding into our locked shred box.

Rule 1: Safe and accessible storage of documents

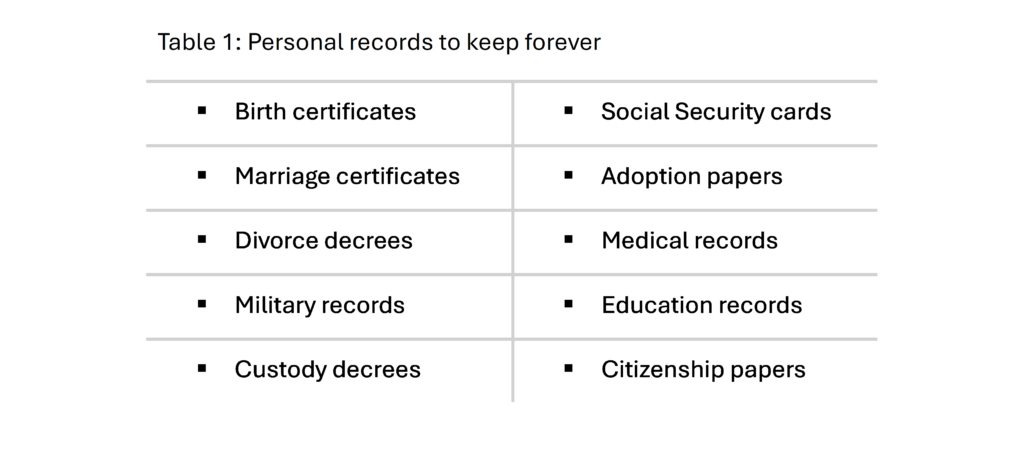

While your digital records are subject to digital theft, physical document storage requires protection from the elements and disasters as well. For hard copy original documents such as birth certificates, Social Security cards, or passports, we recommend using a fireproof safe at home. Renting a safety deposit box at your bank or credit union is also an option if you’re okay with only having access during banking hours.

We recommend scanning or downloading documents that need to be kept on file, but not in their original hard copy. Reminder: it’s so important not to be lulled into digital complacency. Be sure to:

>Review your paperless credit card, bank, brokerage, and other important statements with regular cadence and stay alert for identity-theft red flags.

>Back up your files. Hard drives crash and laptops get lost. Throughout the year, save copies of important documents on an external hard drive and/or in the cloud with a reputable service provider.

>Secure your devices. Use strong passwords, biometrics, and double authentication. Be sure your devices are updated regularly.

Another issue specific to paperless records is limited access to older statements. It may be possible to obtain older records from banks and other financial institutions, but the process is time consuming and likely includes a fee, so before the standard self-access window on your records expires, or before you close an account, download or print the documents you need. In particular, it’s important to retain the cost basis of your investments within taxable accounts.

How long does Raymond James retain your documents?

Raymond James retains statements and tax reports for 14 years and trade confirmations for 6 years. (You can also find trade details within your statements.)

How long do banks retain statements?

Banks are required to keep most records for at least 5 years, but many make account statements available for up to 7 years.

Personal records to keep forever

Homeowner records to keep indefinitely

◊ Record of paid-off mortgages (certificate of satisfaction or lien release)

◊ Closing settlement statement

◊ List of household possessions (updated as needed)

Why you should keep home improvement records

Records of expenses incurred when buying and selling your home or condominium and permanent improvement costs should be retained for seven years after you sell (if you’re eligible, these costs can be added to the original cost basis of your property, potentially reducing capital gains tax on your home sale). Because home price have risen rapidly in the past few years, this has become more of an issue for homeowners.

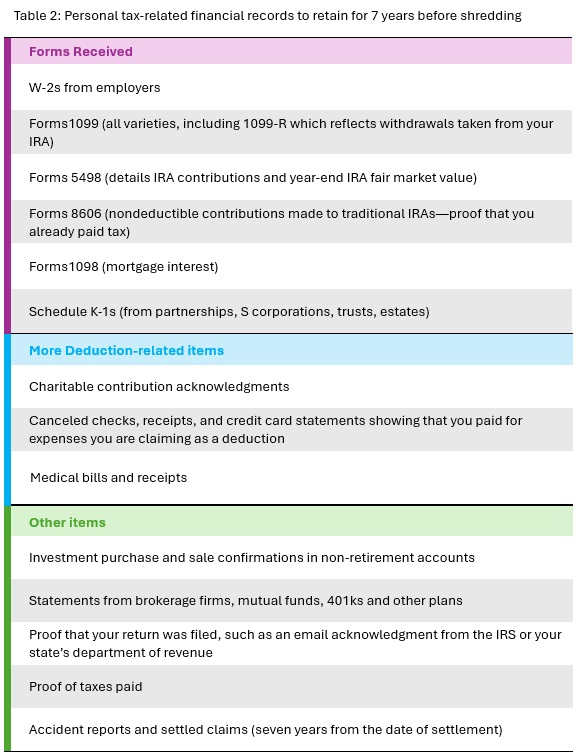

Tax-related financial documents to retain for 7 years

Record retention decisions should be made using both your judgement and state and federal statutes of limitations. The IRS can audit your returns for up to three years after filing, up to six years if underreported income is in question, and indefinitely if there is evidence of fraud. It’s worth noting that many CPAs recommend keeping your tax records forever.

Online banking and paperless setups have reduced the work of maintaining some records. However, be mindful that a digital record that supports your tax filing, such as a check used to support an income tax deduction, may be something you’ll want to download and maintain in your records. Also, if you’re in the midst of house hunting or if you anticipate other types of loans, you’ll want to have the most recent three-month period of printed statements on hand.

We recommend that you keep (whether in hard copy or digitally) all records related to calculating your income tax, plus a few others, for a minimum of seven years including:

These items, once obsolete, can be shredded:

◊ After updating estate planning documents, shred all previous versions of wills, powers of attorney, etc.

◊ Keep your most recent Social Security statement, shred all previous statements

◊ Shred your driver’s license and passport once they expire

Records to retain during length of ownership

If not related to your tax filings, some records need only be retained for the duration of your ownership of them. These include:

◊ Motor vehicle titles, purchase receipts, loan or lease documents, repair records

◊ Burial lot deeds

◊ Large purchase receipts

◊ Warranties until expired and owner manuals (most are now available online)

Retention guidelines for insurance policies

Keep your current documentation and updated proof of insurance as long as your policies remain active. This applies to all types of insurance.

Retain your insurance policy documentation (even if expired) if you have an open claim, along with any documents that support your claim, until the claim is settled.

Retention for bills and bank statements

If not related to your tax filings, some documents can be discarded (or not downloaded) once you’ve verified that payment or other transactions have cleared. This includes household bills, credit card bills, and bank statements.

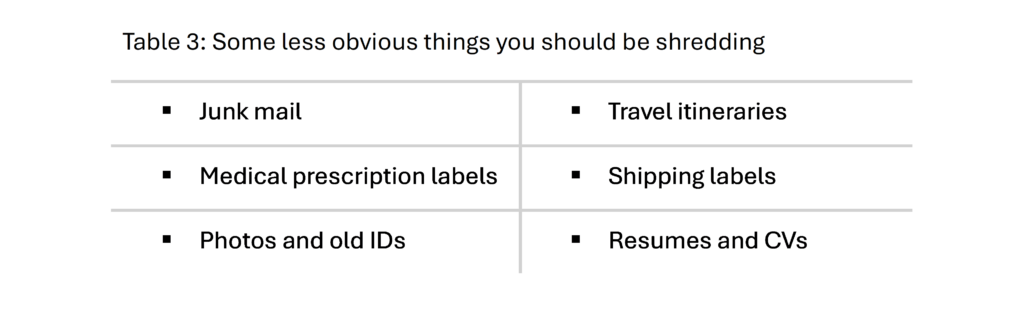

Rule 2: Safe disposal of your documents and devices

Shredding your documents is the best way to dispose of them because it ensures complete destruction. You should shred anything that includes any personally identifiable information. You don’t want your information getting into the wrong hands, and anyone can legally dig through your trash once it’s put out for pick up.

You must also take security steps when parting ways with your electronic devices. After backing up and transferring your data, be sure to wipe or physically destroy the data on those devices before disposing them, including printers.

Things you should be shredding

We hope you find this guide useful. If you have any questions about items not included in our guide, please reach out to your advisor.

Some resources

If you’re interested in a more comprehensive guide, check out Safehome.org’s “Storing Important Documents”

If you’re curious about more items you should be shredding, check out Time Shred’s list.

If you’re interested in how to use your smartphone as a scanner, check out Kurt the Cyber Guy’s video.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by TGS Financial Advisors), or any non-investment related content, made reference to directly or indirectly in this article will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from TGS Financial Advisors. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. TGS Financial Advisors is neither a law firm nor a certified public accounting firm and no portion of this article’s content should be construed as legal or accounting advice. A copy of the TGS Financial Advisors’ current written disclosure statement discussing our advisory services and fees is available upon request.