The Potential Return Advantages of Foreign Stocks

As soon as we read The Case for More Overseas Stock Exposure—And Where in the Wall Street Journal, we knew we wanted to share it with our newsletter readers. We believe the Journal has clearly captured one of the core trends driving our current asset allocation—the extreme valuations for U.S. stocks compared to those of other countries. We’ve emailed a reprint of the article to our subscribers under a separate cover.

As the Wall Street Journal states, using Shiller CAPE figures provides a robust way to think about future returns, in foreign markets just as it does in the U.S. Given that lower CAPEs are associated with higher future returns, the information suggests that most foreign markets are likely to outperform the U. S. over the next ten years.

Any time we observe a significant price anomaly, we need to ask ourselves what it represents. Does the price difference between A and B reflect an underlying difference in economic value? (The answer is often, though not always, “yes.”) Then the key question—is the magnitude of the price difference justified by the likely long-term advantage of the more costly asset? At some point, the answer to that question often becomes, “probably not.”

Are the prospects of U.S. companies so superior that they deserve prices much higher than foreign equivalents? We tend to think not. Just to take one example, U.S. small-cap stocks are priced about 3.5x higher than German companies. Given the dominant position of many German firms in export markets, it really does not seem persuasive that small U.S. companies overall will earn almost four times more than big German companies. (Actually, CAPE suggests that small U.S. companies are likely to earn next to nothing over the next decade—or worse.)

Why are U.S. markets so expensive? In part, because nothing succeeds like success. “Hot” money chases past performance, driving asset past reasonable valuations and ultimately to the point of absurdity, often followed by a devastating crash. Think tech bubble, housing bubble, Bitcoin, and so on.

Given how our minds work, the way we frame a financial question can determine the conclusions we reach. Shiller CAPE suggests that future returns for U.S. stocks will be lower than normal, and possibly much less than many foreign alternatives. But if we present investment decisions solely in the context of over-valuation and risk, we can too easily drive the conclusion, “These guys can’t make any money.” When we suggest investors should look elsewhere for higher returns, we mean “somewhere other than the United States,” not “somewhere other than TGS Financial Advisors.”

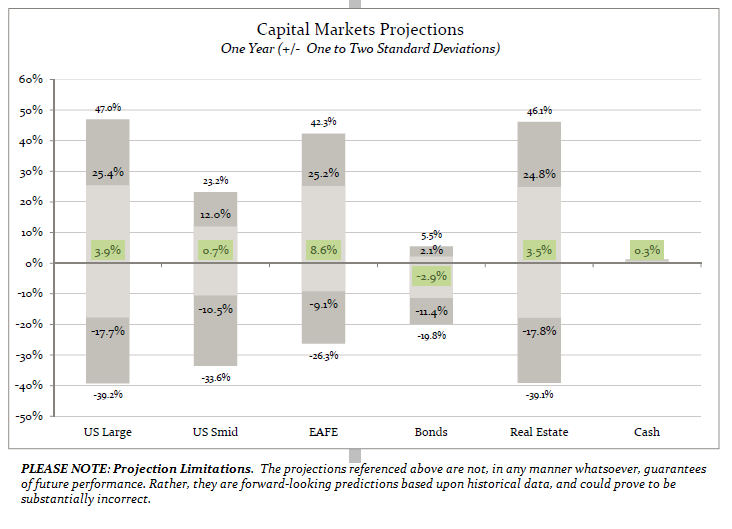

So let’s consider another way of looking at this same data set. Instead of focusing solely on risk, let’s look at a different graphic, one which represents our best estimates of the likely opportunity landscape in global markets, reflecting data we track on both Shiller CAPE and historical relative yields and/or valuations. We make our investment decisions looking forward, not back. Our asset class weightings are informed by our best estimates of the landscape of future returns, and ignore entirely issues of trailing performance.

As you can see, the expected variation of returns over the next twelve months is huge, from -17.7% to +25.4% for U. S. large-cap stocks, for example. But if we focus on our baseline return projections (the numbers in green), we can easily see why our portfolios tilt as they do. If you are at all greedy, like me, you surely feel a tug of excitement contemplating the potential return advantages of foreign stocks.

If we are correct in our analysis, then even a cursory review of the chart above suggests some powerful answers to the eternal question, “What should I own today?” We want to own a high proportion of foreign stocks, and be very careful, especially with small U.S. companies, and most particularly with small U.S. companies in the growth/tech space.

By James S. Hemphill, CFP®, CIMA®, CPWA®/ Managing Director & Chief Investment Strategist

Jim has been a CERTIFIED FINANCIAL PLANNER™ professional since 1982. Jim specializes in complex wealth transfer and retirement transition strategies and coordinates TGS Financial’s investment research initiatives.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by TGS Financial Advisors), or any non-investment related content, made reference to directly or indirectly in this article will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from TGS Financial Advisors. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. TGS Financial Advisors is neither a law firm nor a certified public accounting firm and no portion of this article’s content should be construed as legal or accounting advice. A copy of the TGS Financial Advisors’ current written disclosure statement discussing our advisory services and fees is available upon request.