What We Talk About When We Talk About All-Time Market Highs

During certain parts of the financial market cycle, investors begin to behave less as individuals and more as a herd. As emotions take over, reasoning ability is compromised and calculation gives way to expectation. What is happening right now becomes all important. The chance for profits seems both immediate and certain, while the danger of loss appears theoretical and distant.

The emotions around market-highs and market-lows can be a deadly danger to long-term financial interests.

With the market making a lot of new highs in recent weeks, we’re having those conversations with clients. Honestly, we’ve been around long enough to expect them, and we welcome them because we know that the emotions around market-highs and market-lows can be a deadly danger to long-term financial interests.

At those market inflection points, our job as financial advisors is to refuse to validate our clients’ emotions as a basis for action. We do this, we hope, by reminding them of all the ways that we rely on data when making investment decisions. Heavy stuff.

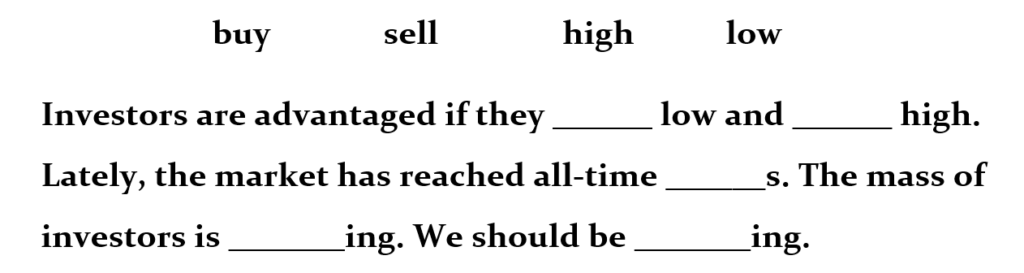

So here’s a fun and very simple Mad-Libs-style exercise about the current exciting market. Fill in the blanks with one of the following four words. (Hint: you’ll only need three.)

Above all, remember that we’re here for you, especially during markets such as these. No article, email, or fun exercise can replace the value of a good old conversation. We look forward to speaking with you soon.

By James S. Hemphill, CFP®, CIMA®, CPWA®/ Managing Director & Chief Investment Strategist

Jim has been a CERTIFIED FINANCIAL PLANNER™ professional since 1982. Jim specializes in complex wealth transfer and retirement transition strategies and coordinates TGS Financial’s investment research initiatives.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by TGS Financial Advisors), or any non-investment related content, made reference to directly or indirectly in this article will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from TGS Financial Advisors. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. TGS Financial Advisors is neither a law firm nor a certified public accounting firm and no portion of this article’s content should be construed as legal or accounting advice. A copy of the TGS Financial Advisors’ current written disclosure statement discussing our advisory services and fees is available upon request.